Contents:

The amount owed to a firm by its customers following the sale of goods or services on credit is known as trade receivables or accounts receivable. On the balance sheet, receivables are classified as current assets. Trade receivables are defined as the amount owed to a business by its customers following the sale of goods or services on credit.

A customer may give a note to a business for an amount due on an account receivable or for the sale of a large item such as a refrigerator. Companies also have non-trade note receivables if they loan money to non-customers. When a company sells goods on account, customers do not sign formal, written promises to pay, but they agree to abide by the company’s customary credit terms. However, customers may sign a sales invoice to acknowledge purchase of goods.

Customer ServiceCustomer Service

In general, receivables should be recorded at the present value of the future cash flows, using a realistic interest rate. Which of the following is a disadvantage of selling on credit? A) Sales can be made to a more diverse group of customers. B) Profits are increased by making sales to a wider range of customers. D) Prices must be reduced when selling on credit. Which of the following is true about the aging method?

3 reasons to lease equipment – Canadian Metalworking

3 reasons to lease equipment.

Posted: Fri, 14 Apr 2023 13:00:00 GMT [source]

All property, plant, and equipment assets are depreciated over time. Functional depreciation occurs when a fixed asset is no longer able to provide services at the level for which it was intended. Expenditures that increase operating efficiency or capacity for the remaining useful life of a fixed asset are called capital expenditures. Capital expenditures are costs of acquiring, constructing, adding, or replacing property, plant and equipment.

Trade debtors, trade receivables, and upping your invoicing game

Polka sold inventory purchased from Song in 20X8. It had cost Song $60,000 to produce the inventory, and Polka purchased it for$75,000. Assume Polka uses the fully adjusted equity method. Analyze the following independent situations. Sophia, Inc. is being sued by a former employee.

C) Some customers do not pay, creating an expense. The number of days of accounts receivable outstanding. Moss Company initially records its short-term notes receivable at ________.

Want More Helpful Articles About Running a Business?

As you can see, it takes Company A around 107 days to collect a standard invoice. C____1.A written promise to pay a specified amount on demand or at a definite time. Normal and necessary risk of doing business on a credit basis. AVAILABLE NOW – Great Beginnings for New Nonprofits, a free 8-part email course on fundraising, financial management and other “must know” topics. Spring Center is a case in point for the importance of receivables.

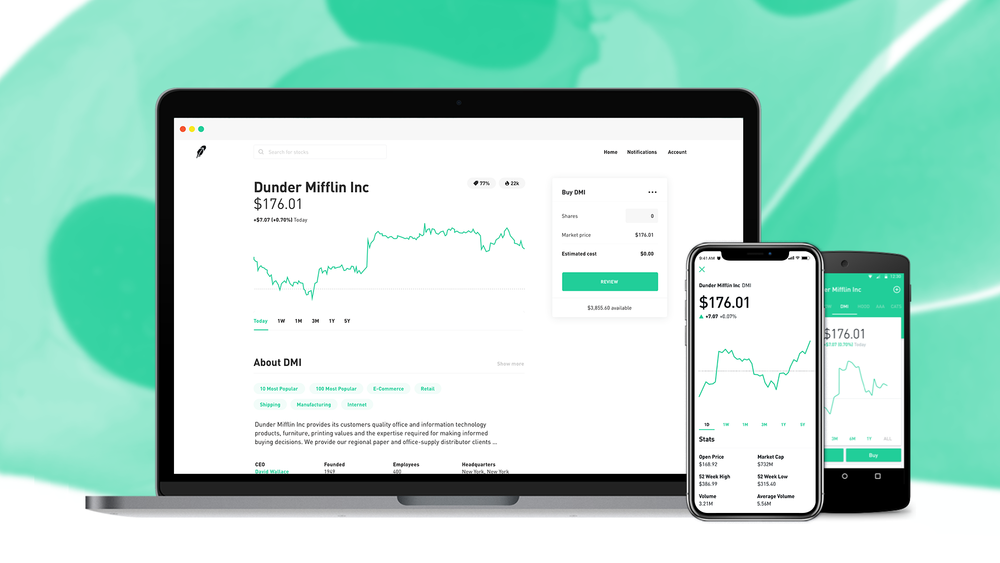

Cleveland-Cliffs Provides Preliminary First-Quarter 2023 Results – Cleveland Cliffs

Cleveland-Cliffs Provides Preliminary First-Quarter 2023 Results.

Posted: Tue, 11 Apr 2023 11:53:06 GMT [source]

Companies can also receive early payment if their customers give them access to early payment programs such as supply chain finance or dynamic discounting. These are initiated by the buyer rather than the seller and tend to provide funding at a lower interest rate than methods such as factoring. Receivables not currently collectible are reported in the investments section of the balance sheet. Emphasizes expected cash realizable value of accounts receivable. This is another simple but highly effective way to get paid more quickly.

Many loyal https://1investing.in/ pay within the specified payment terms, but unfortunately, some don’t, resulting in potential cash flow issues. So, if you forget to record a receivable, you may end up providing your product for free and thus negatively impacting your ability to earn profits. This is one other reason why it’s crucial that you carefully monitor your trade receivables and take action immediately if you notice a missing or overdue payment. As well as referring to trade receivables, the term ‘accounts receivable’ is also used to mean the organization’s team responsible for collecting customer payments.

The majority of small and medium enterprises operate within 30 days. Offering discounts for early payment is a way to encourage clients to pay their invoices more quickly, which can help improve a company’s cash flow. Bill receivables are a formal agreement between a customer and the business agreeing to pay a certain amount within a particular period for the goods or services they receive. On the other hand, debtors are the bill receivables that remain unfulfilled on the due date. You can calculate trade receivables by adding up debtors and bills receivables.

Accounts receivable are usually current assets that result from selling goods or providing services to customers on credit. Accounts receivable are also known as trade receivables. It’s frustrating enough to handle bookkeeping and accounting as business owners; it’s even more vexing when terms like trade debtors and trade receivables are included. To all intents and purposes, many businesses may effectively consider the two words to be synonymous.

In other situations, the amounts owed are referred to as trade debtors. The vast majority of what’s outstanding in most cases will be made up of trade debtors. Overdue receivables are still considered current assets because they are expected to be paid within one year. However, if a receivable becomes overdue and is not collected, it may be written off as a bad debt.

Which of the following is not considered to be a liability? Accounts payable Unearned revenue Wages payable Cost of goods sold. Which of the following is not a liability? Outstanding coupons issued to the customers.

Trade Receivables on the Balance Sheet

Be clear that you will file a claim in the relevant court if they haven’t settled the debt in seven days. Date the letter clearly, and base any future income on that. The difference is that you hold capital assets longer-term, whereas, with other assets like items in stock, you’re expected to turn them into cash in a relatively short period. Shows only actual losses from uncollectible accounts receivable. Yes, it is an asset because the trade receivables’ amount is expected to be fully paid off within one year. It is the total amount receivable to a business for sale of goods or services provided as a part of their business operations.

Notes receivables can also be called trade receivables. On the other hand, accrual basis accounting records income when it is earned and when pledges have been made, not just when they are paid. Expenses are recorded when incurred or as assets are used up. Accrual basis accounting gives a truer picture of the results of business operations.

- They will also be able to see how much income they are making based on cash or accrual basis.

- Through various transactions, a firm may have a legal claim against another entity that should be disclosed as a non-trade receivable.

- The more you wait, the more likely the payment may be delayed.

- Improving how you invoice for labour or goods supplied might be beneficial to every small company.

- To maintain this aspect of your business healthy, you’ll need a dependable billing system in place that promptly and consistently bills your clients.

Send a sales invoice as soon as you complete the project or provide the service you’ve been contracted for. The longer you wait, the longer it is likely for the payment to be delayed. Share a sales invoice as soon as you finish the project or supply the service you were hired for. The more you wait, the more likely the payment may be delayed. Offer early payment incentives and impose late payment fees. There is no greater motivator than money.

- Under double-entry accounting principles, the company will credit the sales account by $475 while also debiting the trade receivables account by the same amount.

- Factoring, for example, enables a company to sell its invoices to a factor at a discount, thereby receiving a percentage of the value of an invoice straight away.

- The direct write-off method records bad debt expense in the year the specific account receivable is determined to be uncollectible.

- Capital expenditures are costs that are charged to stockholders’ equity accounts.

- Companies will establish a subsidiary ledger for accounts receivable to keep up with what is owed by each customer.

To record a trade receivable, the accounting software creates a debit to the accounts receivable account and a credit to the sales account when you complete an invoice. When the customer eventually pays the invoice, the accounting software records the cash receipt transaction with a debit to the cash account and a credit to the accounts receivable account. Accounts payable is the opposite of accounts receivable or trade receivables.

Determine how each contingency should be treated. Determining the adjustment to the cash realizable value of a short-term note. A promissory note holds a _______ legal claim than an account receivable. When a note receivable is honored, Cash is debited for the note’s ________ value. Capital expenditures are costs that are charged to stockholders’ equity accounts.

When the amount california income tax rate exceeds £5,000, you can issue a statutory payment demand. That’s a standard document demanding payment within 21-days. Once that period passes, you can take court action.

The term trade receivables refers to any receivable generated by selling a product or providing a service to a customer. Trade receivables can be accounts or notes receivable. Current assets are accounts that are expected to be converted to cash in the following year. In addition to trade credits, current assets include cash, cash equivalents, stock inventories, and prepayments. Trade receivables are an asset for a company. But if a business is not cash-rich and needs funds immediately for any reason, it can opt for trade receivables financing.